How Can I Help My Board Members Understand the Long- Term Nature of Impact Investing?

Posted on October 9, 2014 by Tomer Inbar, Tony Wells

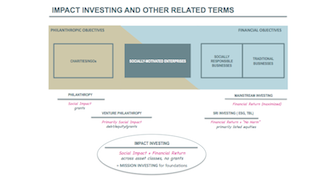

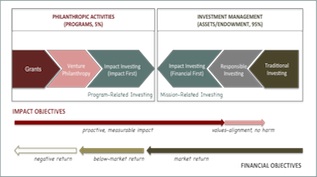

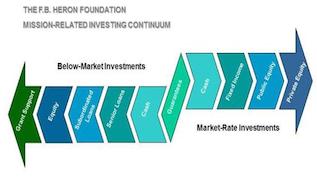

Tomer Inbar: To start with a short anecdote, a client of mine and I were talking about their first program-related investment (PRI) that was going to go under. Although they had a successful program-related investment portfolio, she had to go to the investment committee where her PRIs were managed and tell them that they believed that this company was going… Read More