Trends 2020: Study Methodology and Key Findings

Courtesy of the H.E. Butt Foundation

This excerpt from NCFP’s Trends 2020 study shares data and analysis regarding various US family foundation giving trends, including foundation effectiveness, impact investing and payout, engaging the next-gen, and much more.

Study Methodology

NCFP engaged Phoenix Marketing International (“Phoenix”) to design and conduct a nationally representative survey of family foundations, with oversight by a diverse advisory committee of knowledgeable practitioners. NCFP and Phoenix collected information about family foundations through a 52-question, mixed-mode survey (i.e., mail, web, and telephone) conducted between February and May 2019.

The survey yielded 517 responses, exceeding total responses in 2015 by more than 50%. The Foundation Center’s family foundation database was used to design the sampling frame and was the primary sample source. In total, we invited 2,500 family foundations in the Foundation Center’s database to participate in the survey.1 To be eligible, a foundation had to have assets of at least $2M or annual giving of at least $100,000. We used a random sample of 2,000 family foundations, in addition to an oversample of 500 large foundations that have $25M or more in assets and annual giving of at least $100,000.

In addition to this random sample, family foundations were invited to opt-in and complete the survey online by NCFP and its partner organizations.

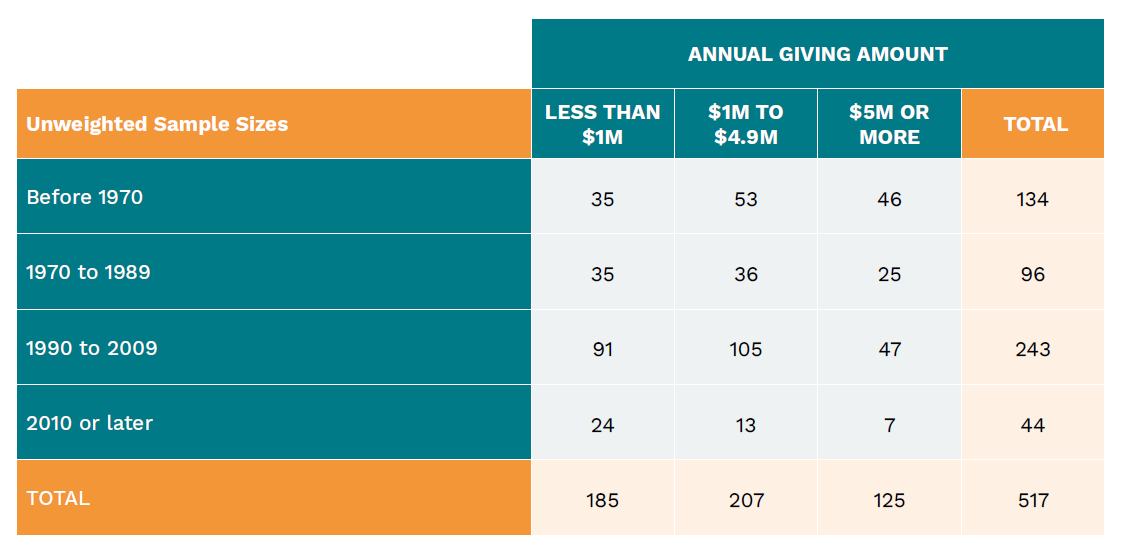

The final sample breakdown by when the foundation was created and by giving level is:

The sample size of 517 is sufficiently large for this population and provides reasonable sample sizes to analyze and measure significant differences for segments of interest. The general rule of thumb in market research is a sample size of 30 or more is a “Large Enough Sample Condition”; sample sizes for most segments of interest are 100 or more and all have sample sizes of 40 or more.

Sample weights were applied to the data to account for oversampling of large foundations and for slightly lower response rates among small foundations. The Foundation Center’s nationally representative database contained 17,336 active family foundations meeting the study requirements and was the basis for weighting the data to the actual population.

1 The Foundation Center and GuideStar merged in early 2019 and formed a new entity now known as Candid.

The findings from this study can be generalized to family foundations across the country based on the

following factors:

- Random selection of the primary sample from all eligible, active foundations in The Foundation Center’s family foundation database;

- Final sample weighting to ensure the sample distribution by size of foundation is comparable to that of the Foundation Center’s database;

- Nationwide representation of family foundations—

Notes Regarding Market Research Practices and Limitations

As with all market research, there are some limitations of this study. Some of the specific limitations include the number of questions asked, which were limited to avoid respondent fatigue, potential misunderstanding or misconstruing of questions, varying knowledge or memory of the respondents, and small sample sizes for less prominent segments. We made every attempt to ensure that questions were clear (via extensive peer review/input) and that an appropriate representative answered the survey (the survey specifically requested that a family member actively involved in the foundation or a knowledgeable board or staff member complete the survey). We have every reason to believe that survey respondents answered the questions accurately to the best of their abilities and memory.

While this study involved a relatively large sample of family foundations, we caution that any sample may fall short of being fully representative of an entire population. Yet, we believe the care in selection of participants combined with the sample size offers the best possible representation of trends across family foundations.

These common limitations of market research do not make findings any less valid or important. NCFP plans to probe some of the questions or areas of interest more deeply through qualitative interviews with members of the family foundation community.

Please contact NCFP with further questions about this study.

Notes Regarding Peer Review:

The Philanthropy team at TCC Group was pleased to have the opportunity to review initial findings from the National Center for Family Philanthropy’s 2019 benchmarking survey. Based on our understanding of the survey methodology, the findings presented appear to reflect a statistically responsible approach. – Steven Lawrence and Melinda Fine

Trends 2020 Key Findings

Foundation Giving Identity: Newer Foundations Focus on Issues

- Older and larger family foundations focus their giving geographically, while the vast majority of newer family foundations (those formed since 2010) focus their giving on issues.

- Compared to 2015 Trends Study results, the oldest foundations are slightly more likely to be place-based than they were five years ago, while the newest foundations are significantly more likely to focus on issues than they were five years ago.

Foundation Effectiveness: Family Relationships and Good Governance Lead to Impact

- Most family foundations say that family members who are engaged in their foundation work well together. The majority also consider their internal operations to be effective. In general, they feel there is room for improvement with the level of impact they are having.

- Foundations that report being “very effective” across these three key measures (operations, family dynamics, and impact) appear to place a much higher priority on governance, and are somewhat less likely to focus on learning about grantmaking and focus areas or issues. These foundations are also more likely to have formalized governance practices and written policies.

- Foundation impact appears to depend more on effective governance and family members working well together, and less so on having effective internal operations.

Foundation Giving: New Family Foundations Focus on Economic Inequality

- Giving amounts have grown since this study was last completed in 2015. However, while giving has increased, the number of grants awarded each year have declined somewhat, indicating there are fewer but larger grants.

- Consistent with findings in 2015, the top two focus areas for family foundations are education and poverty.

- Newer family foundations (those created in 2010 or after) appear to have significantly different giving priorities, with far more focused on economic inequality and/or basic needs funding (including poverty, hunger, or homelessness and economic opportunity/inclusion), and significantly fewer

focused on education. Family foundations continue to use a variety of grantmaking strategies, with a majority reporting they use multi-year grants and general operating support grants. Nearly half say they use capacity-building

grants as an important part of their strategy, representing a decrease from 2015. Newer foundations are significantly more likely to engage in all of these strategies.

Impact Investing and Payout: Newer Family Foundations Lead the Way

- The number of family foundations currently engaged in mission/impact investing has doubled since 2015. Plans to institute or continue expanding mission/impact investing are also up overall from 2015, with nearly one-fourth of all family foundations saying they will institute mission/impact investing in the near future and nearly 30% planning to expand this type of investing.

- Foundations created since 2010 are also much more likely to use program related investments (PRIs) and pursue other mission-related or impact investing approaches.

- These foundations also appear to have very different plans with regard to overall assets and payout strategy. The majority of newer foundations expect an increase in assets in the next four years. The number of family foundations currently engaged in mission/impact investing has doubled since 2015. Plans to institute or continue expanding mission/impact investing are also up overall from 2015, with nearly one-fourth of all family foundations saying they will institute mission/impact investing in the near future and nearly 30% planning to expand this type of investing. One in three will institute mission or impact investing for the first time.

Founder Presence and Donor Legacy: Active Involvement and Adherence to Intent

- Founders remain actively involved in most family foundations, although this has declined slightly since 2015. Foundations consider a founder’s involvement beneficial in several ways, including the founders’ ability to share their values/interests and their community connections. Most family foundations have a clear understanding of their founder’s intent and adhere very closely

to that intent. - Founders have different perspectives than other family members or non-family staff about family dynamics, governance, and impact. Founders are much more likely to feel that older and younger generations are interested in different issues, but less likely to say that generations have different opinions about how to achieve impact.

- Founders are much less likely to express interest in measuring the impact of the foundation’s giving, to place value in communicating the goals and results of the foundation’s giving, or to look for ways to formally integrate outside perspectives into the grantmaking process and/or governance

structures of the foundation.

Engaging The Next Generation: Opportunities for New Leaders

- More than half of family foundations have multiple generations serving on their board. One in ten have three or more generations serving on the board. One-third have at least one member of the third generation on the board, but less than one in ten have family members from the fourth generation or beyond.

- Most family foundations actively engage next-gen leaders in one or more ways. The vast majority provide their next-gen with opportunities to formally participate in grant decision making, either by having a formal next-gen board, allowing next gen family members to participate in grant decisions, or allowing some other level of participation in governance.

- More than one in three family foundations plan to increase younger family member board representation over the next four years and almost the same number plan to give younger family members more say in the operations and giving decisions.

- The most common issues related to generational dynamics include challenges related to time constraints and differing interests across generations. Geographic dispersion of family members is also a common challenge for foundations of all ages.

Governance and Staff: More Diversity and Non-family Leaders

- Two-thirds of family foundation boards include non-family board members. The total number and percentage of non-family board members has grown significantly over the past five years. Foundations created since 1990 are significantly more likely to have at least three non-family board members. On boards where there is at least one non-family member, non-family makes up close to half of all board seats.

- The gender distribution of family foundation boards continues to be fairly even. About one-third of foundation boards include at least one person of color, and about one in ten have LGBTQ representation.

- Nearly 70% of family foundations have non-family staff working for the foundation. About 60% have family members serving in staff roles. However, nearly half say an unpaid family member manages the daily operations versus a paid non-family staff member. Approximately one-quarter have a paid family member responsible in part for daily operations.

- Currently, 25% use Diversity, Equity, and Inclusion (DEI) goals/strategies to guide giving, 16% use outside DEI experts, and 15% say DEI considerations are very influential to their giving approach. DEI considerations are significantly more common in family foundations formed in the past 10 years. Fully one in three family foundations have DEI initiatives in their future plans.

- Newer family foundations are much more likely to report that they assess DEI outcomes and analyze the racial/ethnic/other demographics of grantees.

Transparency and Communication: Opinions and Approaches

- Family foundations appear to have become more transparent in their external communications during the past five years with regard to giving priorities and processes, but continue to have diverse opinions about the value and importance of this transparency.

- The majority of family foundations use at least one type of channel to communicate externally. Social media use (in particular Facebook and Twitter) and blogs are less prevalent across all family foundations, yet are more popular among larger foundations.

- Fewer family foundations are accepting unsolicited inquiries or proposals. Family foundations that self-define as “very effective” appear to be much less likely to accept unsolicited letters of inquiry and/or proposals, yet significantly more likely to solicit feedback from grantees, and somewhat more likely to tell grant applicants why their proposal was declined.

- The newest family foundations also appear to place a higher value on transparency with grantees; they are much more likely to communicate reasons why proposals are declined, more likely to solicit feedback from grantees, and much more likely to engage community leaders, issue-area experts, other grantmaking family foundations, and DEI specialists.

The full Trends 2020 study is available here.