Trends 2020: Foundation Giving

Courtesy of the David and Lucile Packard Foundation

This excerpt from NCFP’s Trends 2020 study shares data and analysis regarding various US family foundation giving trends, including payout rate, influences of giving decisions, discretionary grants, and much more.

Family foundations must make choices around the size, number, and focus of their grants. They also have choices around how much they payout annually, the types of grants they make, and how they interact and communicate with the organizations and individuals they support. This section explores new trends in these and other areas related to foundation giving.

Giving Activity

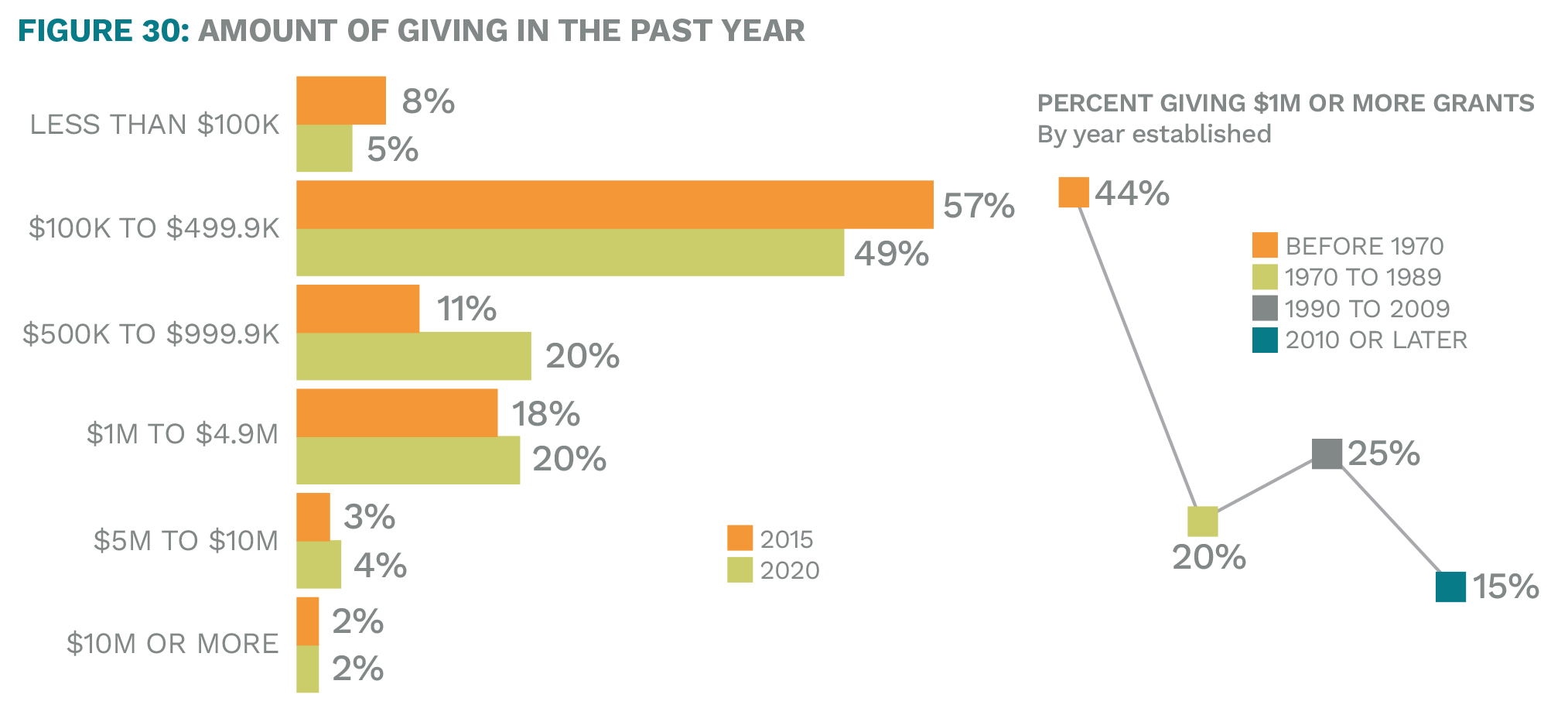

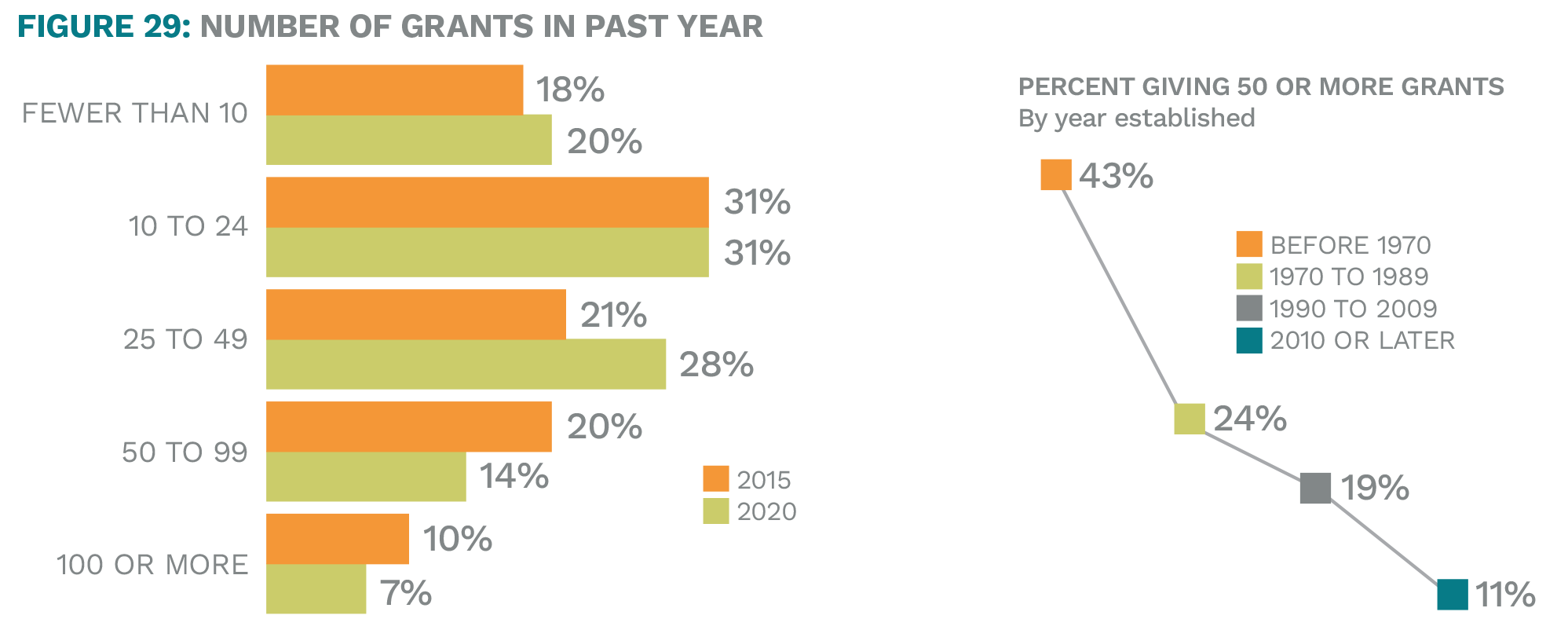

Family foundations are awarding fewer but larger grants than in 2015. Fewer family foundations today are awarding 50+ grants per year, while more are awarding in the range of 25 to 49. More family foundations are now giving $500,000 or more annually.

The giving levels and number of grants of the oldest family foundations (those formed before 1970) are notably higher than those of newer family foundations (those formed since 2010).

Payout Rate

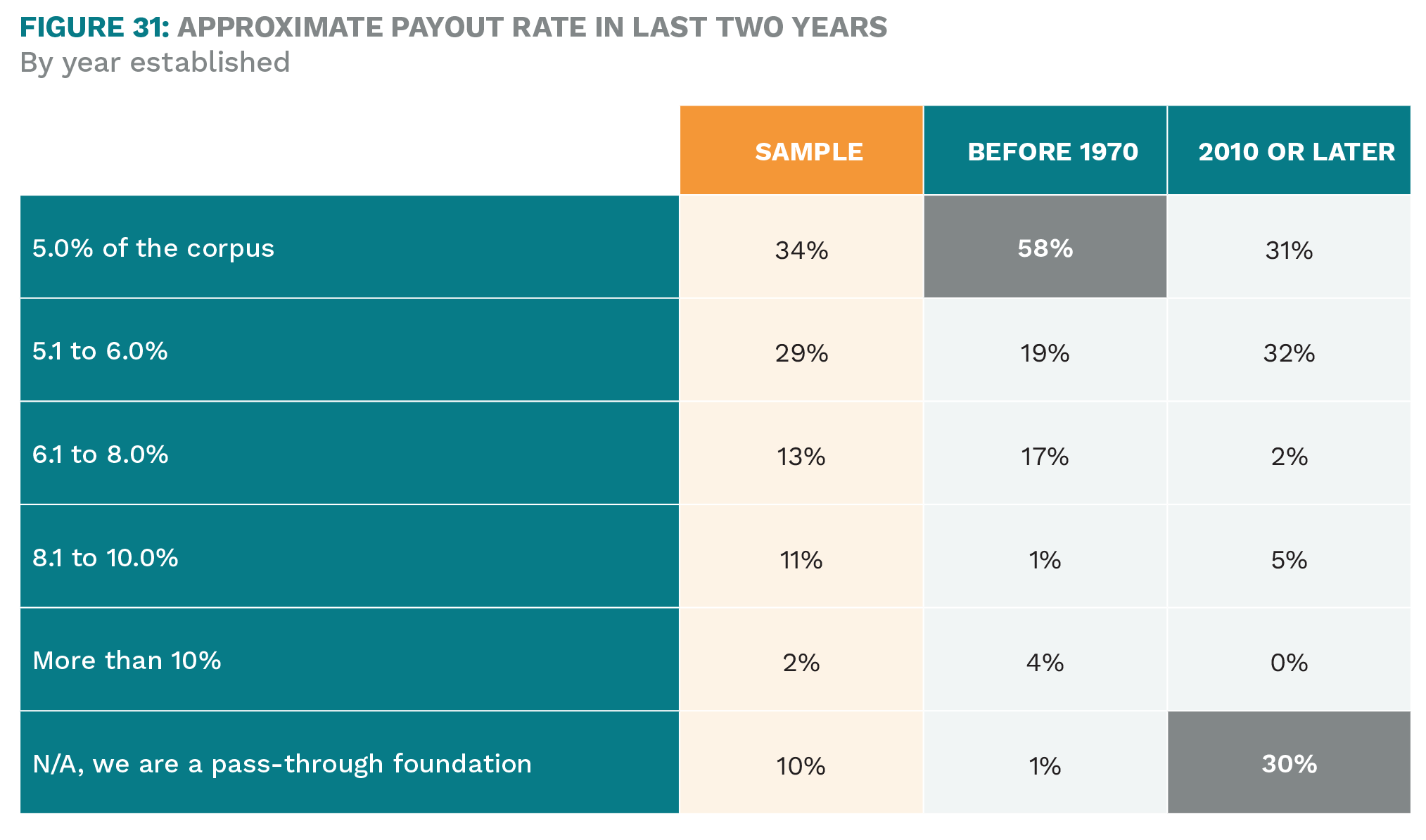

A little more than one-third (34%) of family foundations pay out the minimum of 5%, and another 29% pay out between 5% and 6%. The rest gave more than 6%, with approximately 13% of respondents giving above 8%. Of these, nearly 80% are family foundations created from 1990 to 2009.

Foundations with a higher payout rate (>8%) are also much less likely to self-identify as issue-focused funders, much more likely to allow discretionary grants by board members, and much more likely to have active founder involvement—perhaps indicating that they have not yet been fully endowed.

Overall, these payout rates are comparable to 2015’s rates; however, today more foundations are paying more than the minimum payout, while fewer are giving above 10%. One in ten are pass-through family foundations. The newest family foundations are most likely to be

pass-through family foundations, with approximately 30% of family foundations created since 2010 falling into this category.

As expected, family foundations established before 1970 are most likely to pay out at the minimum of 5%. These foundations are much more likely to be set up as perpetual family foundations.

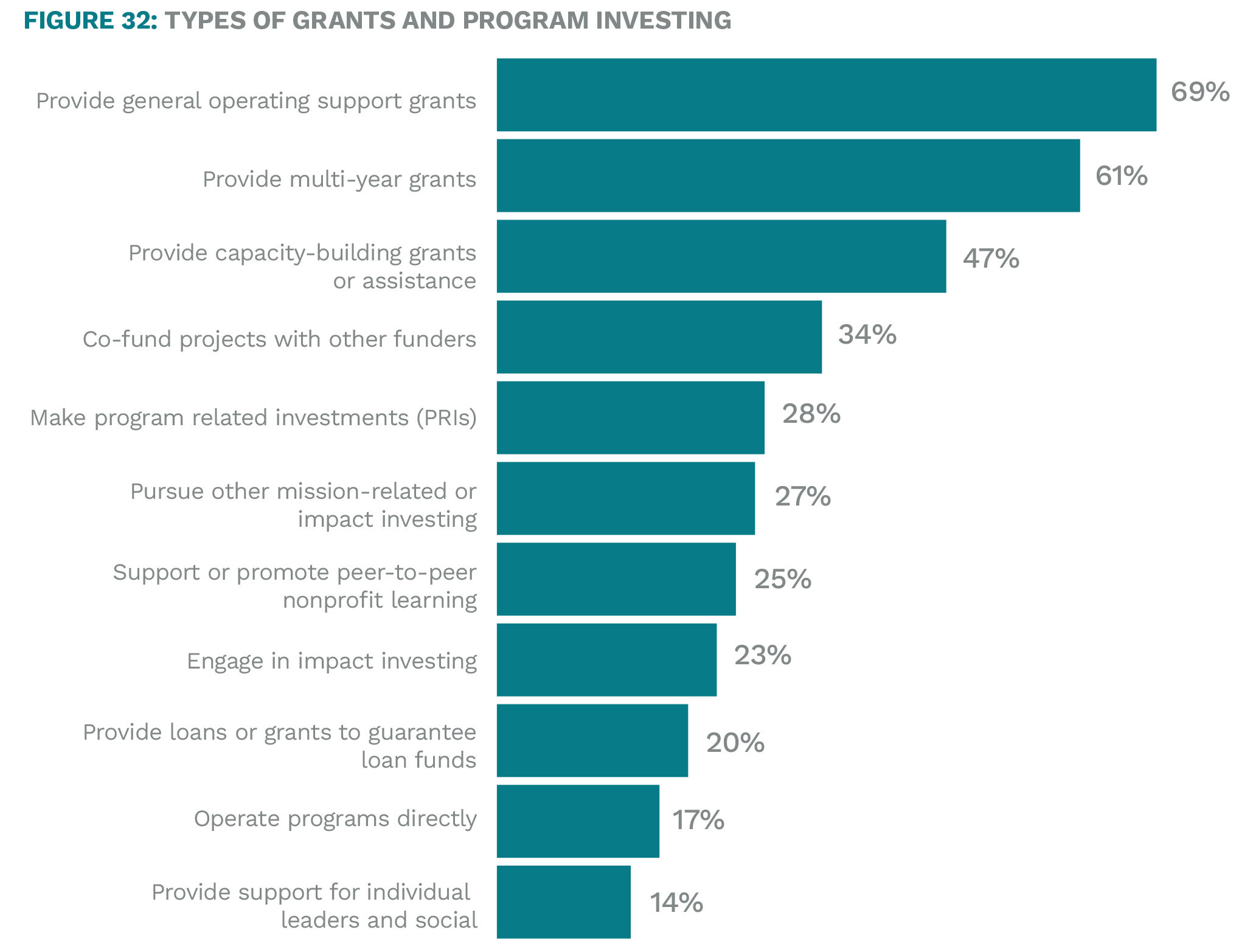

Types of Giving

About two-thirds of family foundations make general operating support grants and provide multi-year grants, and about half provide capacity-building grants. In 2015, the majority of foundations chose these same three grant types.

Program related investments (PRIs) (63%), other mission-related or impact investing approaches (59%), impact investing (47%), and loans/grants to guarantee loan funds (39%) are much more prevalent among family foundations established after 2010.

The largest foundations are significantly more likely to provide capacity-building grants (63%), make PRIs (41%), provide loans/grants to guarantee loan funds (33%), and support peer-to-peer nonprofit learning (40%), while foundations under $10M in assets are the most likely to engage in impact investing. While overall 17% operate programs directly, this is much more common among medium to large foundations (25% for foundations with $1M or more in giving, vs. 15% for smaller foundations).

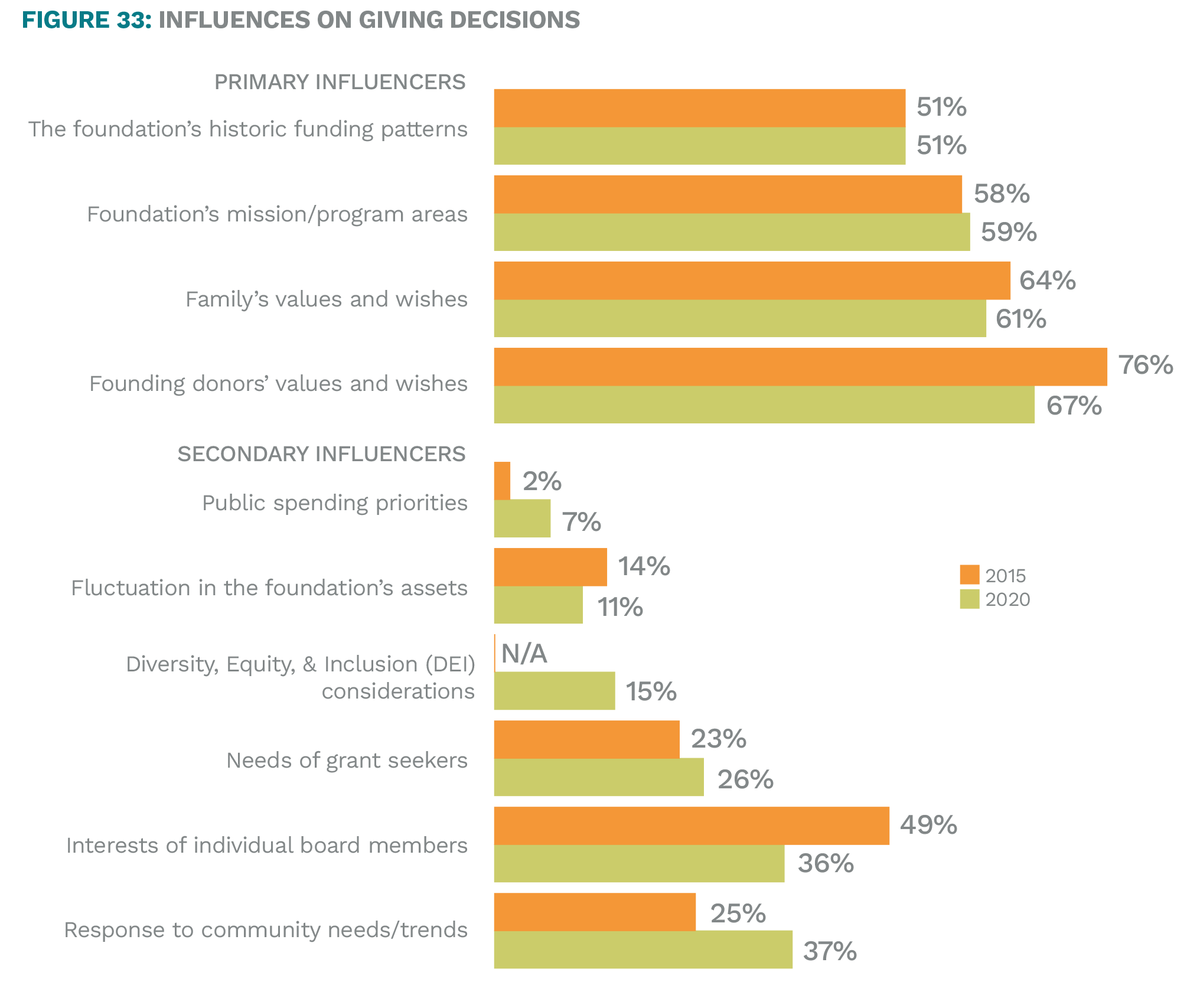

Influences of Giving Decisions

As in 2015, internal factors more strongly influence giving approaches than external factors, although increasingly, foundations say responding to community needs is an influencing factor.

Newer foundations, which more often have an involved founder, are more influenced by that founder’s wishes and the family’s wishes. Older foundations appear less influenced by the founder or family.

More than one-third of newer foundations say Diversity, Equity, & Inclusion (DEI) considerations have “a lot” of influence on their giving approaches (38%, compared to 11% for all other foundations).

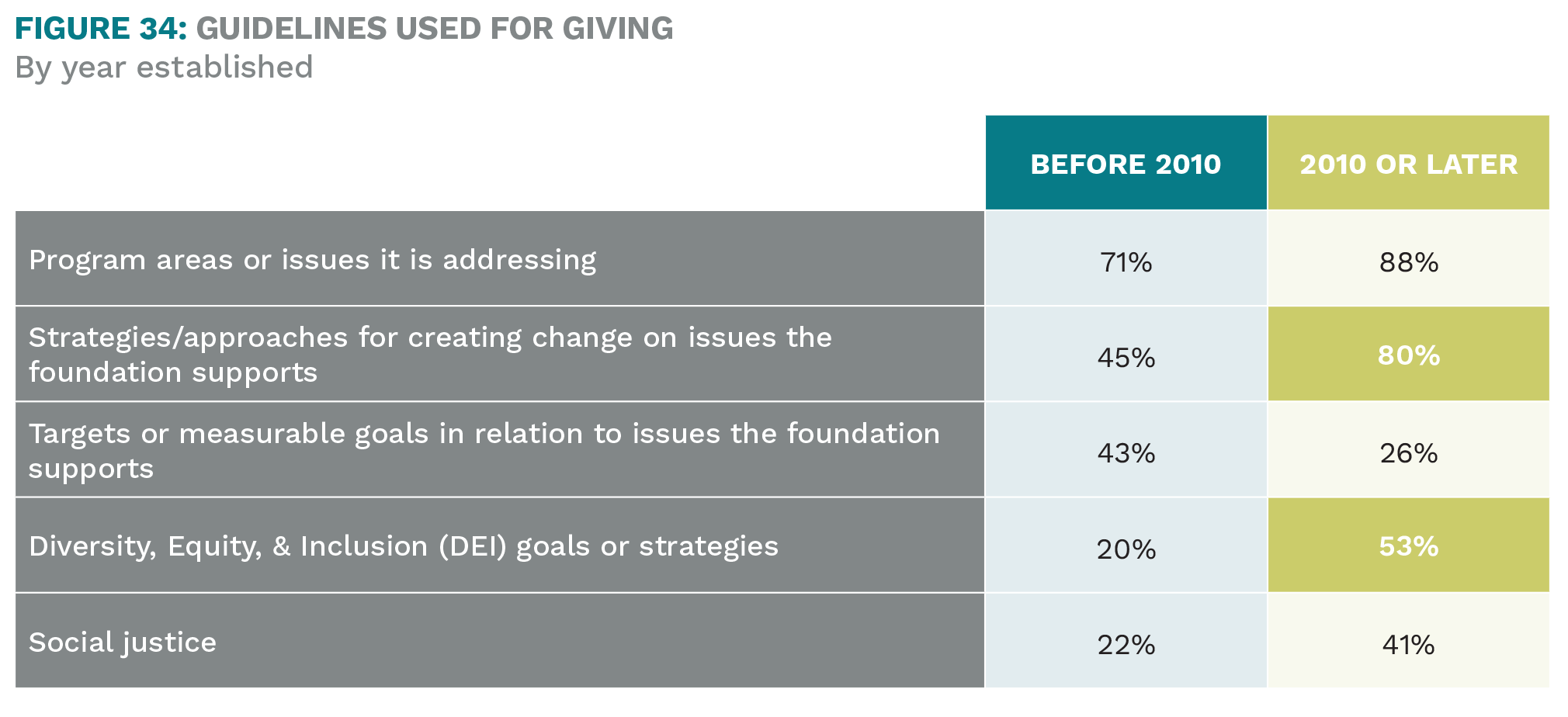

Guidelines For Giving

Roughly three-fourths of family foundations have guidelines in place related to the program areas they support. About half have set guidelines for creating change in the areas they support. Larger family foundations are more likely to have strategies for creating change (73%) and measurable goals (60%) in place.

A significantly higher percent of family foundations established in the past 10 years report having guidelines for creating change (80%), social justice (41%), and DEI goals/strategies (53%).

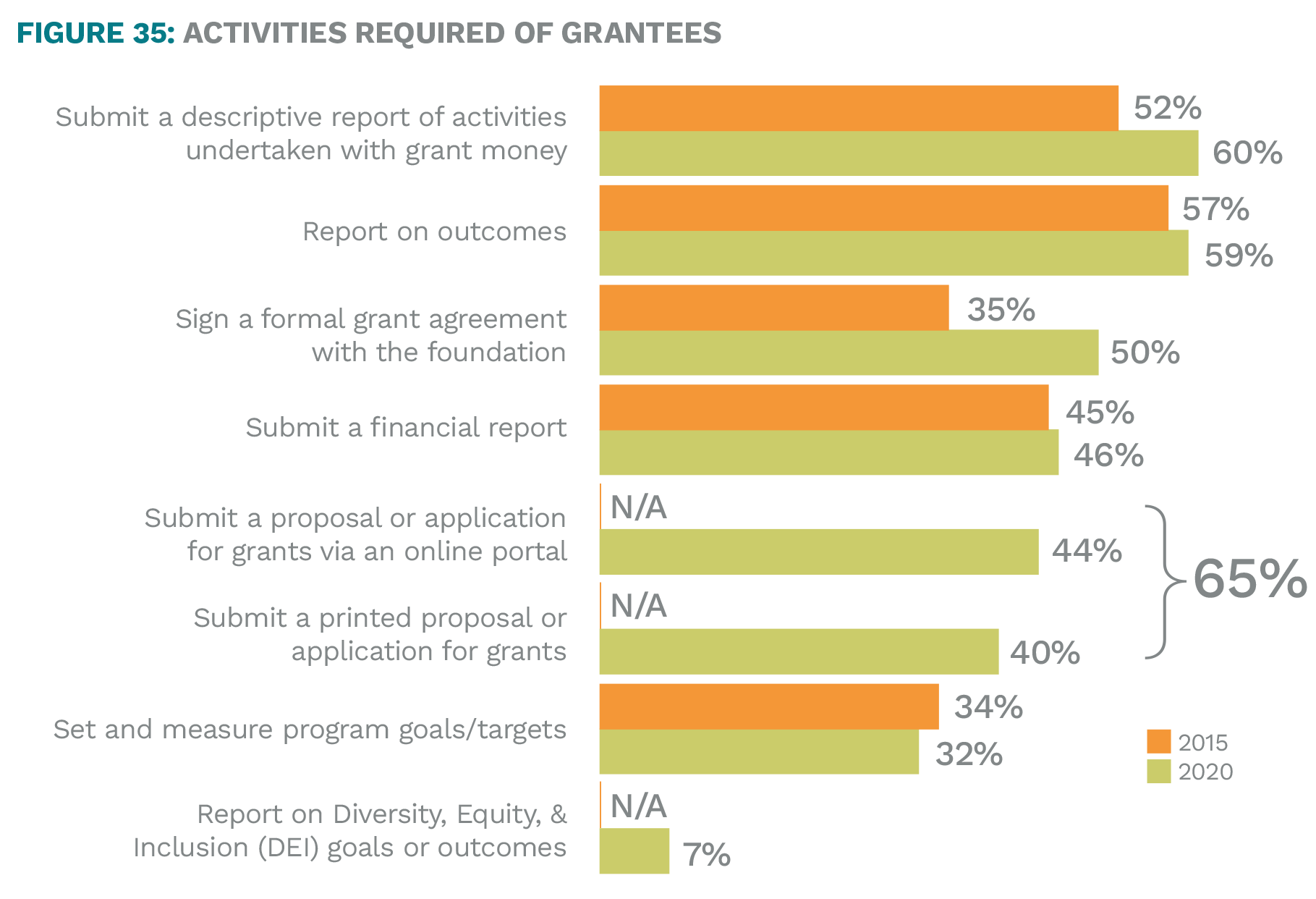

Grants Management Activities

Family foundations are enhancing grants management processes, and in some cases, incorporating additional grant requirements. The majority ask grantees to submit a report detailing how they used grant money, and also to report on outcomes. One-third require grantees to set and measure program goals and targets.

The practice of asking grantees to sign a formal agreement has increased considerably since 2015. Two-thirds require grantees to submit signed applications. Although even the smallest foundations (in assets) require this, incidence is somewhat lower among smaller foundations compared to other foundations (61% with giving levels under $1M, 76% for other foundations).

Assessment of Grants

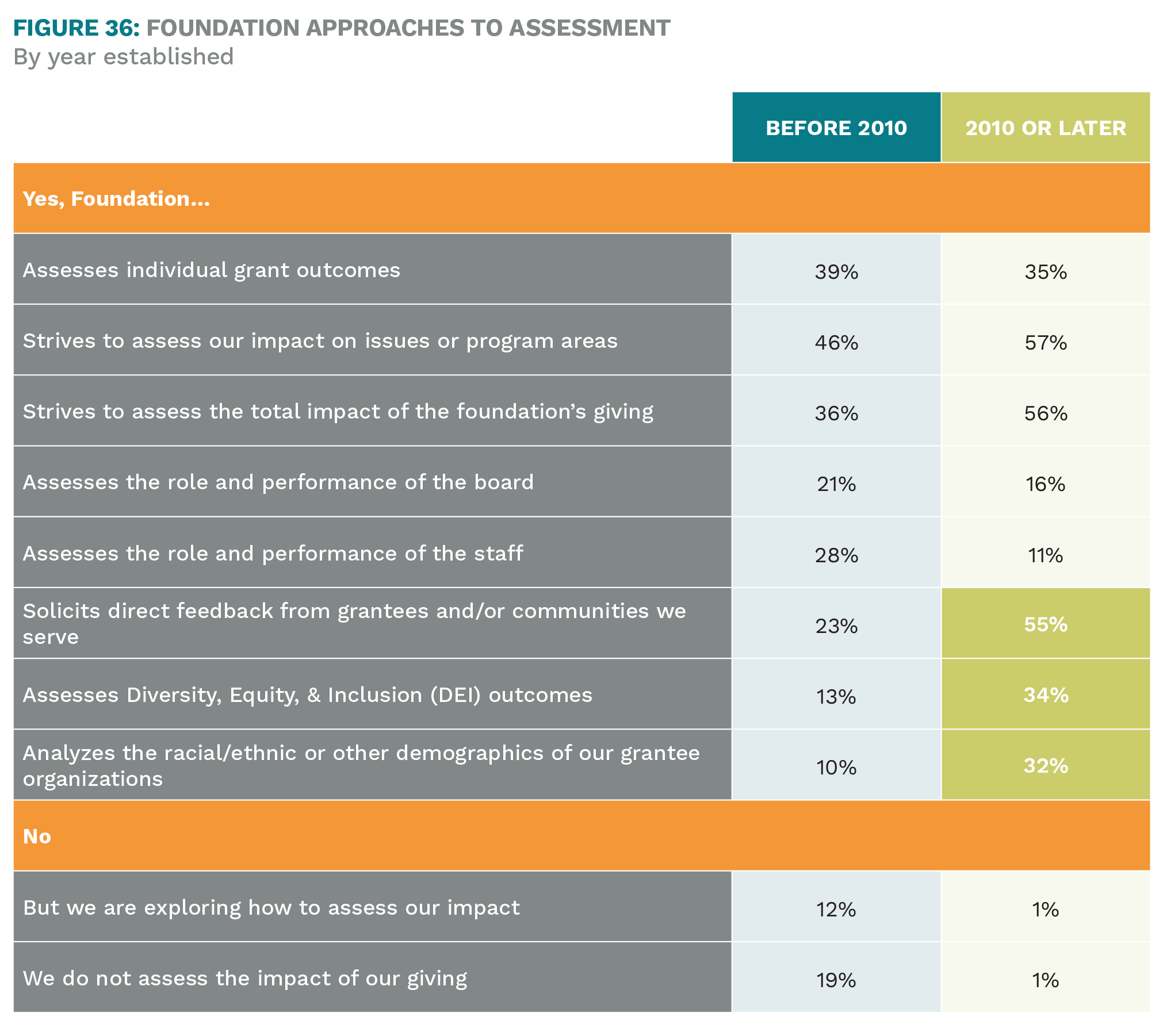

Most family foundations assess the impact of their work in some way. As the age of a family foundation increases, so too does the incidence of assessing impact.

- Family foundations formed before 1990 are more likely to assess staff performance (38% vs. 21% for others), board performance (27% vs. 18% for others), and individual grant outcomes (49% vs. 34% for others).

- Those established in the past 10 years more often assess their total impact (56% vs. 36% of all others), and are much more likely to assess DEI outcomes (34% vs. 13%) and to analyze the racial/ethnic/other demographics of grantees (32% vs. 10%). They are also much more likely to solicit direct

feedback from grantees (55% vs. 23% of all others).

Discretionary Grants

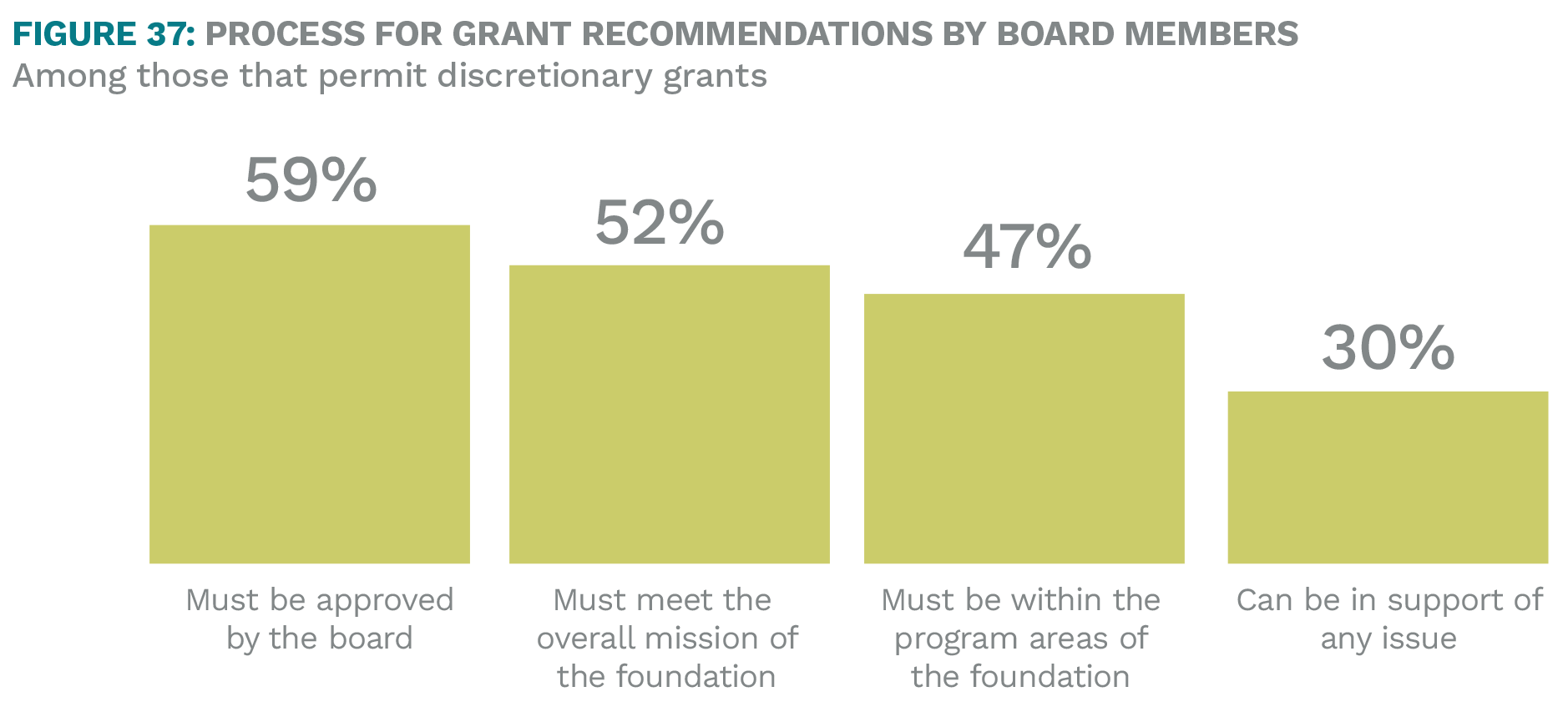

Approximately 64% of family foundations allow individual board members to recommend discretionary grants, with certain parameters in place. Smaller family foundations (less than $10M) are more likely to allow this. This appears to be a significant decrease since 2015, when 86% of respondents indicated that they offer discretionary grants.

Foundations formed between 1970 and 1989 are also more likely than others to allow discretionary grants (76%).

Two-thirds of current family foundations require that discretionary grants meet the overall foundation mission and/or be within the program area of the foundation. 60% specify that these grants require formal approval by the board (see NOTE).

NOTE: Regardless of individual foundation practices on discretionary grants, federal law requires that all grants made by a foundation must be attributed to the foundation, and that all board members have a fiduciary responsibility regarding all grants made by the foundation.

Additional Giving Vehicles Used

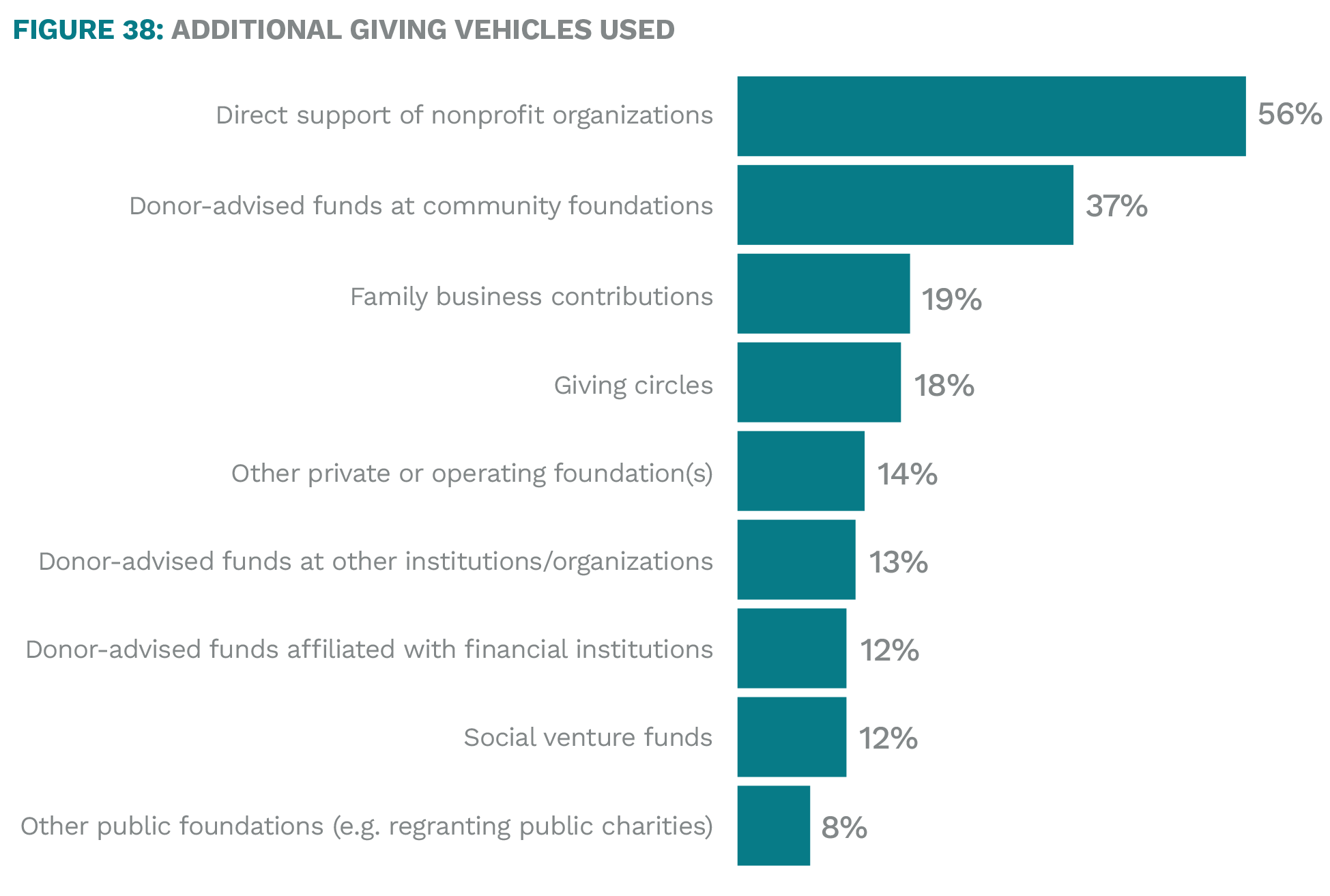

Families and individual family members give in many ways beyond the family foundation. Most commonly, they give through direct individual support to nonprofits. About one-third have set up one or more donor-advised funds (DAFs) at community foundations, while other types of DAFs, including those offered by financial institutions, are less commonly used.

Family foundations that define themselves as place-based are much more likely to use DAFs, in particular those associated with their local community foundation (58% vs. 26% all other respondents).

Place-based foundations are also more likely to participate in local giving circles (25% vs. 14%).

Overall, use of giving circles remains limited, yet is on the rise since 2015 (from 6% to 18%), as is the use of social venture funds (from 5% to 12%). 14% of family foundations report being connected to one or more other private or operating foundation.

The largest family foundations are notably more likely to use donor-advised funds and family business

contributions.

For more on trends related to donor-advised funds, see NCFP’s online guide: Family Philanthropy and Donor-Advised Funds

The full Trends 2020 study is available here.