How do donor-advised funds compare with private foundations and other family giving vehicles?

When setting up a philanthropic vehicle, families often wonder whether to give directly to charitable organizations (check-book giving), or to set up a more formal planned giving vehicle, such as a donor-advised fund (DAF), private foundation, or charitable trust.

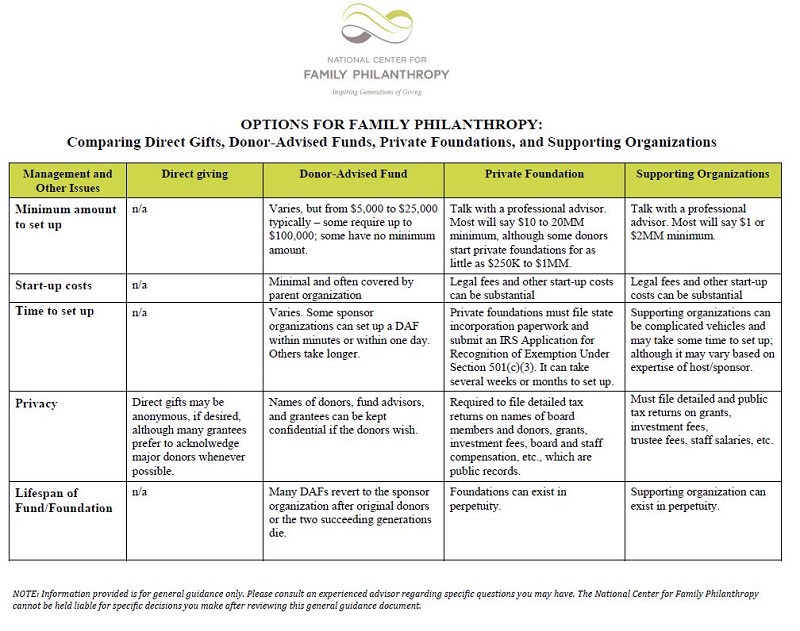

The following provides a brief summary of the most common philanthropic vehicles, and a quick-reference chart that shows the differences between two of the most commonly used vehicles, DAFs and private foundations. In all cases, the transfer of assets to the charitable vehicle are irrevocable and considered a complete charitable gift according to the IRS—meaning the donor takes an immediate tax deduction that same year.

If you have any questions or require advice on this topic please contact the NCFP team.

Private Foundations

In addition to wanting to give and make an impact in causes they care about, many donors start a foundation with family in mind: they wish to express the family’s values long term, engage the next generation, and/or keep the family together over time. Private foundations are often set up in perpetuity, providing a long-term platform for the family to do something positive, together, for generations to come.

In a private foundation, board members have complete control over the investment and grant decisions. Donors can start a foundation with, and hold within it, most any kind of asset – including private equity, tangible assets, real estate, and intangible personal property – though there are limitations to the foundation holding family business assets. The IRS requires a 5% payout rate—meaning, by law, private non-operating foundations must distribute 5% of the value of their net investment assets annual in the form of grants or eligible administrative expenses.

Foundations can also give in ways that may not be available through other vehicles, such as making grants to individuals, running scholarships and fellowships, making program-related investments, engaging in direct charitable activities, and international grantmaking.

Read the Impact Vehicles and Structures Primer.

Donor-advised Funds

A donor-advised fund is a giving account that a donor establishes within a public non-profit sponsor organization, such as a community foundation, university, religious organization, or financial institution. Donors may contribute cash, appreciated stock, real estate, or other financial or business assets (note: more complex assets may result in higher transaction fees). DAFs, like other public charities, offer better tax advantages than private foundations for gifts of illiquid assets and for donors who wish to donate high percentages of their incomes.

The biggest difference between a DAF and a private foundation is control. A private foundation is a legal entity in which the donor or family, if appointed as board members, retains complete control. A DAF is a giving account within a sponsor organization: donors can recommend how funds are invested and granted, but the sponsor organization must approve. A second difference is family legacy—DAFs typically only last one or two generations, whereas private foundations are often designed to go on forever.

Unlike for private foundations, the IRS has no requirement for DAFs on an annual payout amount or when funds must be granted to public non-profits, and DAFs do not have to file tax returns, thus requiring less administration and offering more privacy/anonymity. With that said, data shows that aggregate grant payout rates from donor-advised funds annually exceed 20 percent for every year on record[1].

The biggest difference between a donor-advised and a private foundation is control. The biggest advantage of a donor-advised fund over a private foundation is the immediate tax benefits.

Supporting Organizations

Supporting organizations are flexible and entrepreneurial vehicles for family philanthropy. Families who know the specific causes they wish to support, and who are comfortable sharing control of their grantmaking with publicly appointed board members, may well find supporting organizations to be the most appropriate option for their philanthropic goals.

Families seeking to support the programs and goals of a specific community institution, such as a hospital, university, or museum, may choose to establish supporting organizations with these charities. Families who have more general interests in a community or issue area may establish a supporting organization in partnership with another appropriate public charity, such as a community foundation, Jewish Federation, or other public grantmaking institution.

The rules governing supporting organizations are complicated. Supporting organizations must be “operated, supervised or controlled” by the selected public charity and cannot be controlled by the donor or the donor’s family. One way to satisfy this requirement is to create a board of directors with 50% or more of the voting members appointed by the charity. Donors or family members may also be members of the board, but may not have veto power.

Comparing Donor-advised Funds with Private Foundations

Getting Started: Comparing DAFs and PFs (NCFP, 2019)

Note: all comparisons and benefits of DAF and private foundations in the above chart are subject to change. None of the above data should be taken as tax advice. Please consult an accountant or other tax professional for financial advice.

Other Philanthropic Vehicles

Donor-advised funds differ from other philanthropic vehicles in various ways.

Check book giving is how it sounds: donors decide to give various amounts of cash to various organizations, sometimes planned, sometimes on a whim, and sometimes on an as-needed, responsive basis. Unlike DAFs, donors must track their own contributions and receipts to receive an annual tax deduction.

Some sponsor organizations (e.g., community foundations) offer other types of funds in addition to DAFs. These include unrestricted funds, field-of-interest funds, designated funds, and more. Each type of fund has its own rules and benefits. Ask the sponsor organization for details on other types of funds.

Charitable remainder trusts (CRT) provide the donor or others with cash flow while obtaining a current-year personal income tax deduction. CRTs are different from DAFs in that they generate income for the donor or beneficiaries for a specific amount of time (or for the beneficiary’s life). After this period, any assets remaining in the trust pass to one or more non-profits, chosen by the donor. In most cases, a family’s private foundation can be named as the charitable beneficiary as well.[3]

Charitable lead trusts (CLT) allow donors to use a portion of their assets to create a trust—the income from which will go to charitable organizations, chosen by the donor, with cash flow for a designated number of years. Any assets remaining in the CLT upon its termination pass to the donor’s family, free of estate and gift taxes. This allows donors to efficiently transfer assets to family members, while reducing their tax liability and making a charitable impact. It differs from DAFs in that assets from a DAF do not pass back to the donor’s family—the sponsor organization typically absorbs the DAF assets within one or two generations, depending on the sponsor’s policy on successor generations.

The majority of people who give do it out of current income; they have their favorite non-profits, and they write the checks. It’s a prescriptive way of doing it, with no thought into how to make this money work for the longer term. As you move to a DAF, you’re bringing in that next level of sophistication—putting the corpus into something that remains, and that can support your giving over time.”

– Bob Roth, Donor Advisor, Grand Rapids Community Foundation

Donor Voices: Keeping the Family Together with Two Philanthropic Vehicles

“I have four children and nine grandchildren,” says Bill Cross of Greensboro, North Carolina, “and I wanted to give them an example of how to do something for the community as well as provide a framework for keeping them together as long as possible.”

Bill and Ellen Cross settled on a donor-advised fund, which they named the Cross Family Fund. “I believe a donor-advised fund at the community foundation will encourage the children and grandchildren to keep in touch and bring them together to listen to each other’s ideas” says Cross. “I want each family member to have a voice in deciding what causes we will support, so that each will give serious thought to community needs.” Additionally, Bill and Ellen established a charitable remainder trust to provide income for the couple now, with the remainder to be added to the Cross Family Fund upon their deaths.

– Submitted by Gay Young, Vice President of Donor Services, The New York Community Trust

Next in the DAF Guide: What Are the Most Recent Data and Trends on the Establishment and Use of Donor Advised Funds in the U.S.?

[1] 2017 Donor-Advised Fund Report. National Philanthropic Trust, 2017.

[2] Types of Charitable Vehicles, Foundation Source: https://www.foundationsource.com/learn-about-foundations/charitable-vehicles/